21

Dec,2025

21

Dec,2025

Lift Chair Coverage Eligibility Checker

Check Your Lift Chair Coverage Eligibility

If you’re struggling to stand up from your regular chair, you’re not alone. Millions of older adults and people with mobility issues rely on lift chairs to stay independent. But here’s the real question: what diagnosis will cover a lift chair? It’s not just about needing help to sit or stand - insurance and Medicare have strict rules. Without the right medical documentation, you could pay $1,500 or more out of pocket.

Why Lift Chairs Aren’t Automatically Covered

Lift chairs aren’t classified as luxury items by Medicare or private insurers. They’re considered durable medical equipment (DME), which means they must be medically necessary. That’s where diagnosis codes come in. Just saying you have arthritis or back pain won’t cut it. You need a specific, documented condition that directly impacts your ability to stand from a seated position without assistance.Medicare Part B will cover the lift mechanism - not the entire chair. The frame, upholstery, and cushioning are considered non-covered. So if your chair costs $2,200, Medicare might pay $600 for the lift motor and frame mechanism, and you’ll pay the rest. Private insurers vary, but most follow similar rules.

Approved Diagnoses That Qualify for Coverage

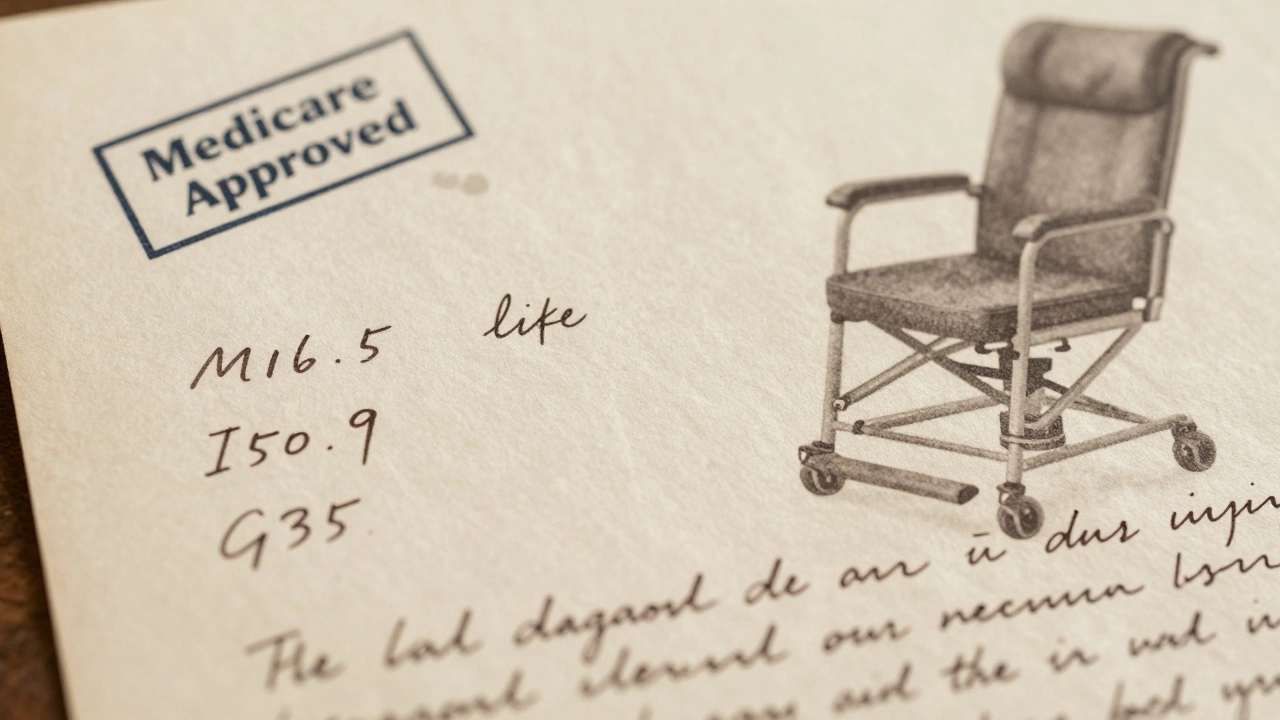

Medicare and most insurers accept these diagnoses as valid reasons for lift chair coverage:- Severe osteoarthritis of the hip or knee (ICD-10: M16.5, M17.1) - When joint pain makes standing painful or impossible without help.

- Congestive heart failure (ICD-10: I50.9) - When standing causes shortness of breath or dizziness due to reduced cardiac output.

- Neuromuscular disorders (ICD-10: G35, G36.0, G71.0) - Conditions like multiple sclerosis, Parkinson’s, or muscular dystrophy that weaken leg muscles.

- Severe rheumatoid arthritis (ICD-10: M05.9) - When joint deformities prevent normal movement and weight-bearing.

- Post-surgical recovery (ICD-10: Z98.89) - After hip or knee replacement, if your doctor certifies you can’t stand without assistance for at least 3 months.

- Chronic obstructive pulmonary disease (COPD) (ICD-10: J44.9) - When standing triggers severe breathlessness.

These aren’t guesses. They’re official ICD-10 codes used by doctors and insurers. If your diagnosis isn’t on this list, you’ll need to prove why your condition makes standing unsafe or impossible without mechanical help.

What Your Doctor Must Document

A diagnosis alone isn’t enough. Your doctor must complete a detailed letter of medical necessity. This letter needs to include:- Why you can’t stand from a regular chair without using your arms or help from another person.

- How standing without assistance risks falls or injury.

- Why a lift chair is the best solution - not a walker, grab bar, or raised toilet seat.

- How long the need is expected to last (must be at least 3 months).

- Your functional limitations: Can you stand from a 17-inch chair? A 14-inch chair? What happens when you try?

Doctors often skip this step because it takes time. But without it, your claim will be denied. Many patients get rejected because their doctor wrote, “Patient has arthritis,” and nothing else. That’s not enough.

How to Get Started: A Step-by-Step Process

1. See your primary care doctor or specialist. Don’t go to a physical therapist or DME supplier first - they can’t write the required documentation. 2. Ask for a formal evaluation. Say: “I need help standing from my chair. Can you evaluate whether I qualify for a lift chair under Medicare?” 3. Be specific about your daily struggles. Tell them: “I use the armrests to push up. I’ve fallen twice trying to stand. I can’t get up without help.” 4. Request the letter of medical necessity. Don’t assume they’ll write it. Ask directly: “Can you write a letter stating my diagnosis and why I need a lift chair?” 5. Choose a Medicare-approved DME supplier. They’ll handle the paperwork, submit the claim, and deliver the chair. You can find them on Medicare.gov’s supplier directory. 6. Get the chair, not just the lift. The supplier will bill Medicare for just the lift mechanism. You’ll pay the difference for the chair frame and fabric.What If You’re Denied?

Denials happen - often because the documentation is too vague. If you’re denied:- Request a written explanation from Medicare or your insurer.

- Ask your doctor to revise the letter with more detail - include measurements of your chair height, your standing time, and any fall history.

- File an appeal within 120 days. Many approvals happen on the second try.

Some people have successfully appealed by adding a physical therapy assessment showing their muscle strength is below 3/5 on the manual muscle test scale. That’s concrete evidence insurers can’t ignore.

Private Insurance vs. Medicare

Medicare is the most common payer, but private insurers like UnitedHealthcare, Aetna, and Blue Cross often have similar rules. However, some plans cover more of the chair cost. Always check your plan’s DME policy. Call the number on your card and ask:- “Do you cover lift chairs?”

- “What diagnosis codes do you accept?”

- “Do I need prior authorization?”

Some plans require you to rent the chair first for 3 months before buying. Others cover the full cost if you have a qualifying condition and a doctor’s note.

What Doesn’t Qualify

Don’t waste time trying to get coverage for these reasons:- “I like to recline.” - That’s comfort, not medical need.

- “I’m tired of bending over.” - Unless you have a diagnosed mobility impairment, this isn’t enough.

- “My back hurts.” - Back pain alone doesn’t qualify unless it’s tied to a neuromuscular or severe degenerative condition.

- “My spouse said I need one.” - Personal opinion doesn’t count. Only medical documentation does.

Real-Life Example

Margaret, 78, from Geelong, had osteoarthritis in both knees. She could stand from her sofa but only by using her arms and leaning forward. She’d fallen twice trying to get up alone. Her doctor diagnosed her with M17.1 (primary osteoarthritis of knee) and wrote a letter explaining her fall risk and inability to stand without assistance. Medicare approved $620 for the lift mechanism. She paid $890 for the rest of the chair. She hasn’t fallen since.What to Look for in a Lift Chair

Not all lift chairs are the same. Medicare only covers the lift mechanism, so you can choose the chair style. Look for:- Two-position or infinite-position recline - two-position is cheaper and often covered.

- Weight capacity - most cover up to 350 lbs; heavy-duty models cost more.

- Power options - single-motor (lift only) vs. dual-motor (lift + recline).

- Warranty - at least 1 year on the motor, 5 years on the frame.

Brands like Golden, Pride, and La-Z-Boy are commonly used. Avoid cheap online chairs with no warranty or service support - they break, and Medicare won’t replace them.

Final Tip: Don’t Buy First, Ask Later

Too many people buy a lift chair online, then try to get reimbursed. That almost never works. You must get approval before you buy. Work with a Medicare-approved supplier. They’ll handle the pre-authorization and make sure the claim is filed correctly.If you’re unsure, call 1-800-MEDICARE and ask for their DME coverage guide. It’s free. It’s clear. And it’s the only way to avoid wasting thousands of dollars.

Can I get a lift chair covered if I don’t have Medicare?

Yes, but it depends on your private insurance plan. Most major insurers like UnitedHealthcare, Aetna, and Blue Cross cover lift chairs if you have a qualifying diagnosis and a doctor’s letter of medical necessity. Check your plan’s DME policy or call customer service to confirm coverage rules.

Does Medicaid cover lift chairs?

Medicaid coverage varies by state. In most states, Medicaid covers lift chairs as DME if you meet income limits and have a qualifying diagnosis. You’ll still need a doctor’s letter and to use a Medicaid-approved supplier. Contact your state’s Medicaid office for specific rules.

Can I rent a lift chair instead of buying one?

Yes, some Medicare Advantage plans and private insurers allow you to rent a lift chair for 3-6 months before purchasing. This is often required if your condition is temporary, like after surgery. Rental costs are usually applied toward the purchase price.

What if my doctor won’t write the letter?

If your primary doctor refuses, ask for a referral to a geriatrician, physiatrist, or physical therapist. These specialists are more familiar with DME requirements and often write these letters routinely. Bring a printout of Medicare’s DME guidelines to your appointment to help them understand the process.

How long does the approval process take?

If your doctor provides complete documentation, approval usually takes 5-10 business days. If additional info is needed, it can take up to 30 days. Start the process early - don’t wait until you’re in pain to begin.

Next Steps if You’re Considering a Lift Chair

1. Write down your daily struggles: How many times a day do you need help standing? Have you fallen? Can you stand from a regular chair without using your arms? 2. Schedule a doctor’s appointment and ask for the letter of medical necessity. 3. Find a Medicare-approved DME supplier in your area using Medicare’s online tool. 4. Don’t buy anything until you have approval in writing. 5. Keep copies of every document - diagnosis, letter, claim number, and approval letter.Getting a lift chair covered isn’t about luck. It’s about paperwork. Do it right, and you’ll get the support you need without paying a fortune.